Get the free tax transcript sample pdf

Show details

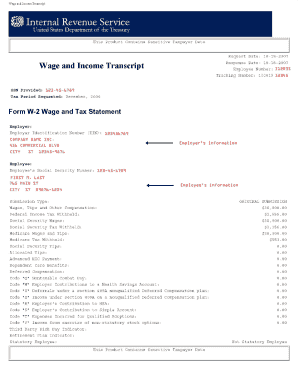

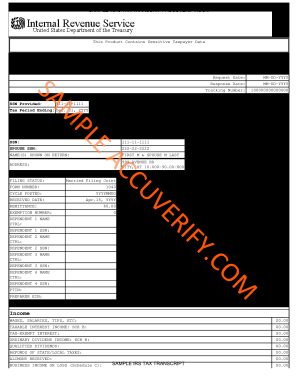

Internal Revenue Service United States Department of the Treasury Request date MM-DD-YYYY Response Date MM-DD-YYYY Tracking Number XXXXXXXX Tax Return Transcript SSN Provided 000-00-0000 Tax Period Ending Dec. 31 2011 The following items reflect the amount as shown on the return PR and the amount as adjusted PC if applicable. They do not show subsequent activity on the account. Name s SHOWN ON RETURN SPOUSE SSN 000-00-0000 FIRST LAST ADDRESS FILING STATUS FORM NUMBER CYCLE POSTED RECEIVED...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax return transcript example form

Edit your irs transcript sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agi on tax transcript example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample of tax transcript online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs transcript example form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample irs transcript form

How to fill out tax return transcript example:

01

Gather all necessary tax documents, such as W-2s, 1099s, and any forms related to deductions or credits.

02

Visit the Internal Revenue Service (IRS) website and locate the form needed to request a tax return transcript.

03

Fill out the required information, including your name, Social Security number, and the tax year for which you are requesting the transcript.

04

Choose the appropriate delivery method for receiving the transcript, such as by mail or electronically.

05

Double-check all entered information for accuracy and completeness before submitting the form.

06

Wait for the tax return transcript to be processed and delivered according to the selected delivery method.

Who needs tax return transcript example:

01

Individuals who are applying for student financial aid may need to provide a tax return transcript as part of the application process.

02

Certain lenders or creditors may require a tax return transcript to verify income for loan or credit applications.

03

Tax professionals or accountants may need tax return transcripts to prepare accurate tax filings for their clients.

Fill

tax return transcript example 2022

: Try Risk Free

People Also Ask about agi on transcript example

How to fill out a 4506-T form?

0:37 2:12 Learn How to Fill the Form 4506-T Request for Transcript of Tax Return YouTube Start of suggested clip End of suggested clip Six you must select the type of tax return which you are requesting. Such as a 1040. Return 1065.MoreSix you must select the type of tax return which you are requesting. Such as a 1040. Return 1065. Return or 1120. Return you must next select the type of transcript. You want to receive.

Can I get a transcript of my tax return?

You may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call 800-908-9946. Please allow 5 to 10 calendar days for delivery. You may also submit Form 4506-T. The time frame for delivery is the same for all available tax years.

What does tax return transcript mean?

• Tax Return Transcript: A tax return transcript shows most line items including AGI. from an original tax return (Form 1040, 1040A or 1040EZ) as filed, along with any forms and schedules. It doesn't show changes made after the filing of the original return.

What is a 4506-T form used for?

Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript.

What is a return transcript?

• Tax Return Transcript: A tax return transcript shows most line items including AGI. from an original tax return (Form 1040, 1040A or 1040EZ) as filed, along with any forms and schedules. It doesn't show changes made after the filing of the original return.

Is tax return the same as return transcript?

The tax return is a form filed with the IRS that is used to determine an individual's tax liability. Forms include the 1040, the 1040A, or the 1040EZ. The tax return transcript is a document tax filers can request from the IRS that includes the information submitted on the tax return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in irs transcript without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing the following items reflect the amount as shown on the return and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the tax return transcript example 2021 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your sample irs tax transcript in seconds.

How do I complete example of tax transcript on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your example of irs transcript. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is tax return transcript example?

A tax return transcript is a summary of your tax return information as reported to the IRS. It includes details like adjusted gross income, tax liability, and filing status but does not include all line items from the return.

Who is required to file tax return transcript example?

Individuals who need to provide proof of income or tax filing status, such as students applying for financial aid or individuals applying for loans, may be required to file a tax return transcript.

How to fill out tax return transcript example?

To request a tax return transcript, you can use the IRS Form 4506-T. Fill out your personal information, select the type of transcript you need, and specify the year or years required before submitting the form.

What is the purpose of tax return transcript example?

The purpose of a tax return transcript is to provide a taxpayer with a summary of their tax return information for use in various applications, such as loans or student financial aid.

What information must be reported on tax return transcript example?

A tax return transcript must report key information such as the taxpayer's name, filing status, adjusted gross income, total tax, and certain other line items from the original tax return.

Fill out your tax transcript sample pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Transcript Sample is not the form you're looking for?Search for another form here.

Keywords relevant to w2 transcript example

Related to tax return transcript pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.